In a bid to ensure everything goes smoothly, Xiaomi eventually decided to first file for an IPO in Hong Kong, then later at a more opportune time, issue CDRs.

Xiaomi thinks in the future, its profits will come mainly from internet services and stakes in Mi ecosystem companies.

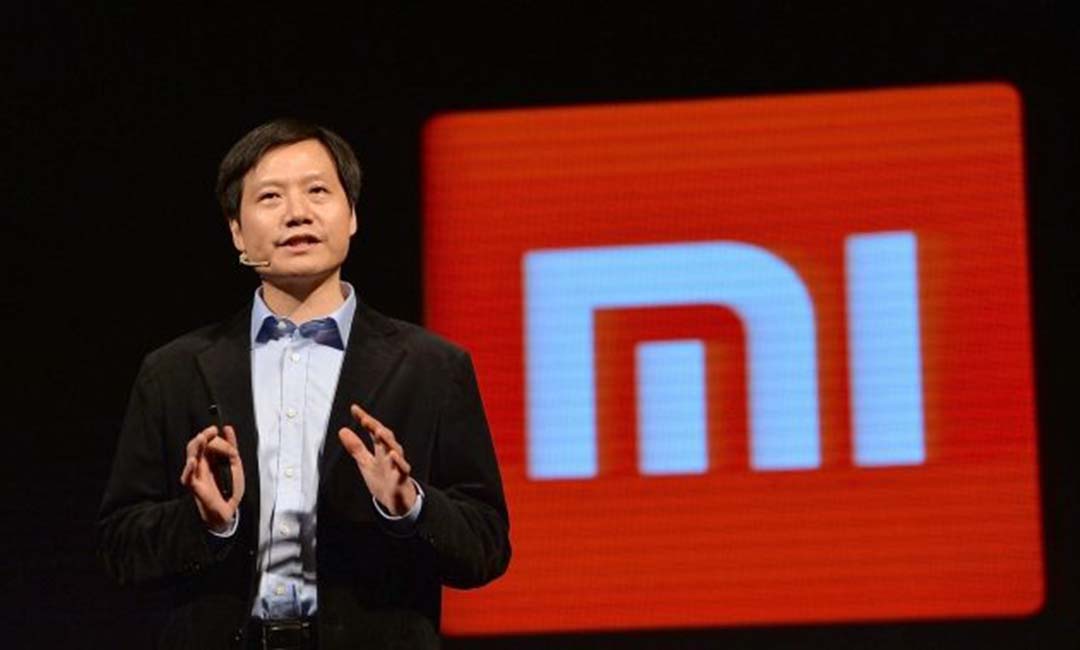

On June 23, Xiaomi held a press conference in Hong Kong, where founder Lei Jun delivered his speech, and senior executives attended to the media thereafter, regarding the company’s CDR application, gross margin improvement and plans to build rockets.

Below is the Q&A transcript:

Q: You mentioned in your briefing just now that what’s most unique about Xiaomi is its new business model, which encompasses hardware, retail and internet services. What is it that has made such a model possible?

Lei Jun: I think the establishment of Xiaomi’s business model is attributed largely to our core entrepreneurial team, which is made up of seasoned professionals from various industries. The members of our early team were mostly those who had worked at companies like Google, Microsoft and Kingsoft (金山软件) and had immersed themselves in the internet sector for over two decades. It requires a highly skilled team to build an integrated model. Xiaomi wouldn’t have gone this far if its core team had been a batch of fresh university graduates. I think our company, with its innovative business model, possesses huge potential for future growth.

Q: How will Xiaomi boost its gross margin and revenue in the future?

Lei Jun: The gross margin for the hardware devices was only 8.7% last year. But thanks to its unconventional operational strategies, Xiaomi generated some of its gross profits from the e-commerce and new retail platforms. Hardware devices have a rather slim gross margin, but that doesn’t mean the company can’t make money. In the future, our profits will come mainly from internet services and stakes in Mi ecosystem companies. The margin on hardware devices will be kept at 2% to 3%, no more than 5%.

Xiaomi now operates the world’s largest IoT platform for smart consumer devices – over 100 million devices have been connected to the platform worldwide. Last year, mobile phones sales contribution to Xiaomi’s total revenue dipped 70%, but earnings from IoT devices made up more than 20%. The growth was quite significant. I believe that figure will climb further to 40% or 50% some time later.

Q: Xiaomi postponed its CDR offering a while ago and instead became the first to file for a Hong Kong IPO with a weighted-voting rights structure under new listing rules. What are your thoughts on Xiaomi’s listing in Hong Kong and how is it different from a CDR offering? Why did Xiaomi change its decision at this point in time?

CFO Zhou Shouzi: With regards to the question about the CDR, first and foremost, the CDR system is a remarkable innovation in the Chinese capital market which we fully support. Xiaomi is incredibly honored to be one of the piloting companies participating in this CDR program, and this also shows that Xiaomi is being recognised by the Chinese regulatory authorities. In the past few months, we had made a lot of preparations for the issuance of our CDRs, but in a bid to ensure everything goes smoothly, we eventually decided to first file for an IPO in Hong Kong, then later at a more opportune time, issue CDRs. This decision was supported by China Securities Regulatory Commission and other regulators.

With regards to being the first to list in Hong Kong with a weighted-voting rights structure, we are absolutely positive about Hong Kong’s acceptance to this structure as there are many that adopt this structure in the new economy, especially in the U.S. This structure will allow the management team of our company to bring long-term benefits to shareholders, customers and employees.

As for your last question, I think being an enterprise we tend to focus more on the development of a market in the long run. Short-term fluctuations are very important, but it is long-term development that matters more. The Hong Kong market and the mainland market both differ in certain ways. In the Hong Kong market, we can reach out to international investors, whereas in the mainland market we engage primarily with domestic investors.

Q: Xiaomi has been growing at a high rate over the past three years. But why has the increase in its inventory and receivables been greater than that in its revenue?

Zhou Shouzi: The inventory and the receivables of our company are both maintained at healthy levels. The company has a positive cash flow. You can see the details in our prospectus.

Q: Xiaomi’s new integrated business model is like no other, but it seems the company has long been striving to offer a variety of affordable products and services to increase its market presence and acquire massive amounts of user data, but for investors, is there any new strategy?

Lei Jun: Indeed, Xiaomi has long been offering a wide range of affordable products and services, but the new integrated business model is more about resource mobilization and cost reduction throughout the entire value chain. Xiaomi is seeking to vertically integrate the whole process from research and development to marketing and sales, instead of just concentrating on one or two links of the supply chain.

Xiaomi’s strategy is also to develop popular products under each category. Our internet business is also an inseparable part of our integrated strategy. Once it gains scale, our user experience will be improved and revenue growth will be fueled.

Q: I hope I am not driving this too far, but does Xiaomi have any planto build rockets?

Lei Jun: Xiaomi has a group of engineers who aspire to explore new grounds. This is exactly why we can make mobile phones with full screen displays and those with transparent glass back panels. We’ll see if we can branch out into more new areas in the future.

Q: Xiaomi has chosen seven cornerstone investors from more than 30 candidates, and all of the seven are Chinese-funded firms. Why isn’t there any foreign investor? Are you satisfied with the company’s current valuation?

Zhou Shouzi: I am not allowed to disclose the valuation. We are very grateful to all candidates for their support. The selected investors are all companies that we have been working with very closely, and they each will claim a reasonable percentage of share in our company.

Q: Xiaomi decided to delay its CDR offering in the wee hours of Tuesday. Can you elaborate further on the reasons behind this decision? When will the CDR application process be resumed? What is the optimal timing?

Zhou Shouzi: We don’t have a timetable for that at the moment. After discussion with regulatory authorities we decided to postpone our CDR offering. We may consider entering the A-share market through the issuance of CDRs after our IPO in Hong Kong. Primarily, we want to make sure our CDRs are of high quality.