China’s BOE Technology Group, one of the world’s largest makers of liquid crystal display panels, could possibly join Samsung and LG Display to become the top three producers of flexible organic light-emitting-diode (OLED) screens, if it were to nab smartphone orders from Apple and Xiaomi.

This comes as Apple is “aggressively testing” BOE’s flexible OLED displays, and is in the final stages of certifying advanced smartphone displays from BOE for iPhones, the Nikkei Asian Review reported Wednesday.

Analysts including Kuo Ming-Chi from Tianfeng Securities said Apple may take BOE as one of the screen suppliers for its new iPhones slated for launch in 2020. Neither US nor Japanese display makers have been able to provide sufficiently high-quality OLED technology to Apple, the report added.

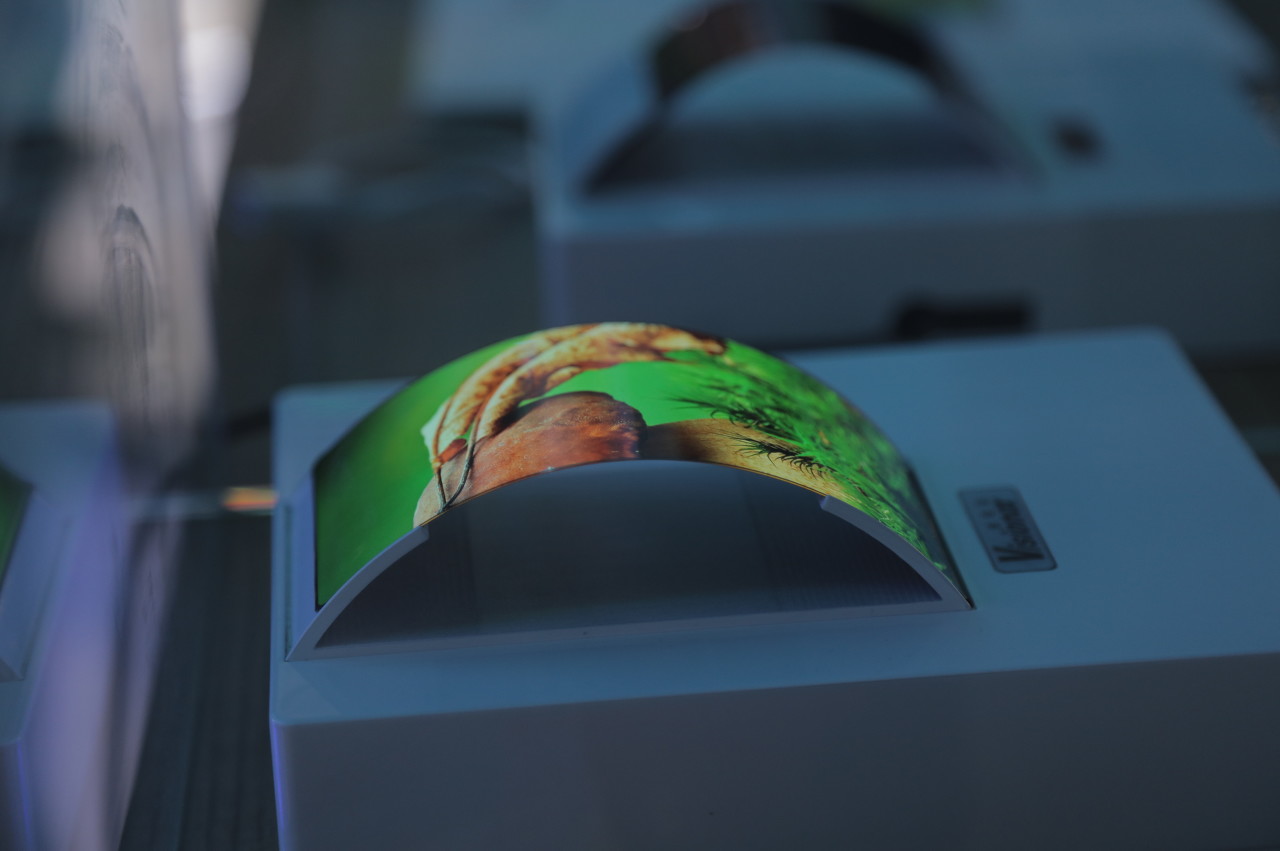

Flexible OLED screens are advanced displays which use an electric current passing through thin films of organic materials to generate light, therefore consuming less power. Such displays are bendable, offer better contrast and color, and could be used in high-end smartphones, wearable and other electronic devices. Samsung and Huawei are slated to roll out their first phones with flexible OLED screens in September.

BOE, along with a slew of other Chinese display makers, are striving to break into the flexible OLED market dominated by Samsung and LG Display. They aim to meet the stringent requirements of smartphone makers especially Apple by improving the displays’ yield rate.

As Apple is cutting its reliance on Samsung panels to diversify sources of supplies, this will open a window of opportunity for Chinese and Japanese makers.

BOE has announced plans to operate three factories to produce its sixth-generation active-matrix OLED, a variant of OLED. On Thursday, it unveiled a RMB 46.5 billion (USD 6.6 billion) plant in Mianyang of southwestern province of Sichuan. BOE’s first such plant in Chengdu, the capital of Sichuan, has commenced mass productions since late 2017, while its third plant in Chongqing of southwest China is currently under construction.

Another potential boon for BOE comes as Japan earlier this month removed South Korea from its “whitelist” of trusted trading partners. Tokyo limited certain exports to South Korea last month, including three materials crucial for OLED displays production. The move further dampens prospects for LG Display and Samsung to retain their capacity and presence in the current market.

Li Weilin contributed to this report.