Beijing-based e-learning firm iHuman plans to raise USD 84 million in its downsized IPO, selling 7 million American depositary shares (ADS) at an expected price range between USD 11 and USD 13 per ADS, according to an amended registration statement published on October 5. The firm will list on the New York Stock Exchange under the symbol IH, with Citigroup, Credit Suisse, Tiger Brokers, CMBI, and CLSA as underwriters.

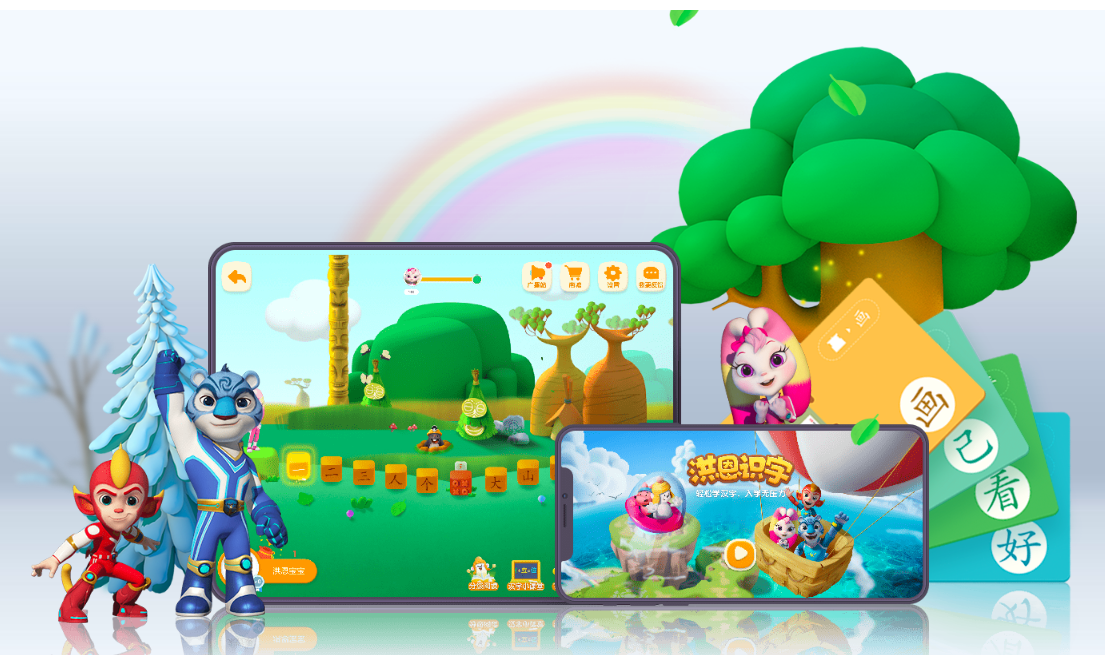

iHuman, which launched its first app in 2016, is one of the leading childhood edutainment firms in China providing learning apps targeting children aged between three and eight. It had previously expected to raise USD 100 million, according to a earlier filing on September 8.

With 10.3 million average monthly active and 1.4 million paid users in the second quarter of this year, the company aims to utilize the net proceeds to expand its product offerings in China and overseas and improve its technology, according to the filling.

For the first six months ending June 30, iHuman reported a net income of RMB 5.6 million (USD 820,000), reversing a net loss of RMB 271.8 million in the same period a year ago. Its revenue also doubled to USD 26.3 million compared to the same period last year.

The news comes at a time when a clutch of Chinese firms like Bain Capital-backed Chindata Group are raising funds in the US, amid increasing tension between the two superpowers.