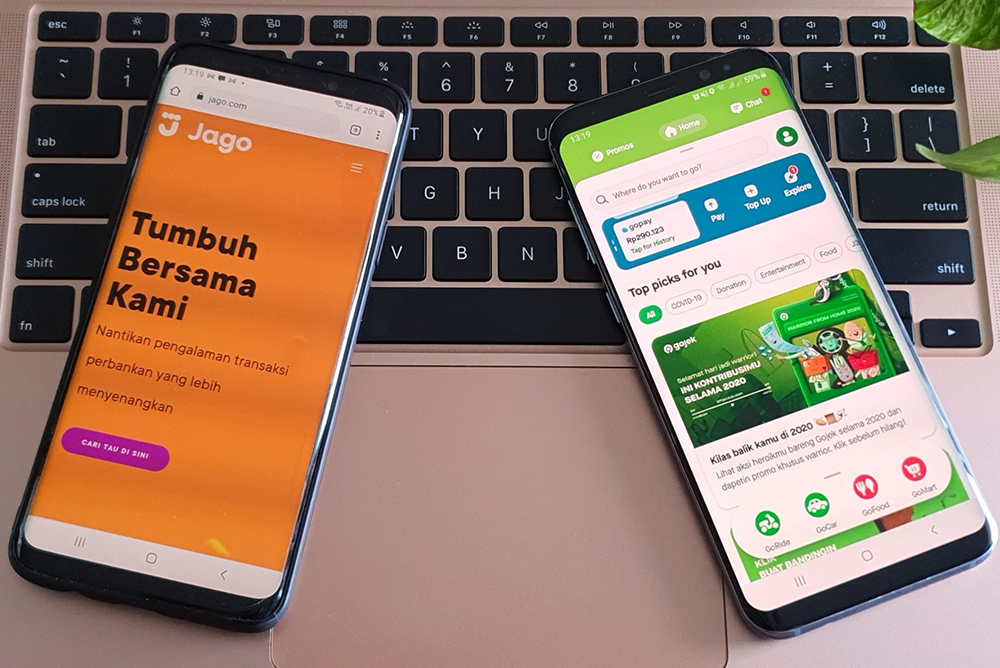

Indonesian super-app Gojek on Friday announced that it invested in Bank Jago, a Jakarta-listed digital bank, accelerating its plans to enter the sector. For Jago, it will open up the possibility to provide its services on Gojek’s platform.

“Jago’s tech-based banking solutions will supercharge Gojek’s ecosystem offerings and facilitate access to banking services for the mass market,” said Gojek’s co-CEO Andre Soelistyo in a statement.

The partnership will be a template for the company on how to extend banking services to its customer base. “Our aim is to leverage more partnerships like this, to ultimately make the Gojek app a reliable resource for everyone’s financial needs,” Soelistyo added.

The investment was made through Gojek’s payments and financial services arm, which holds around 22% of Bank Jago. Local media Katadata reported earlier today that more than IDR 1.2 trillion (USD 85.2 million) of Jago stock was traded on the Indonesian Stock Exchange (BEI), signaling a new investor. The bank’s controlling shareholders continue to be Metamorfosis Ekosistem Indonesia, owned by senior banker Jerry Ng, and Patrick Walujo’s Wealth Track Technology, which hold a combined 51%.

Bank Jago was founded in 1992 under the name PT Bank Artos Indonesia. Earlier this year, it changed its name to PT Bank Jago Tbk, as part of its transformation to become a digital bank. Since Walujo, a co-founder of Indonesian investor firm Northstar Group, has backed Gojek since its early days, rumors indicating that Bank Artos will become a digital bank and handle Gojek’s transactions had been around since 2019.