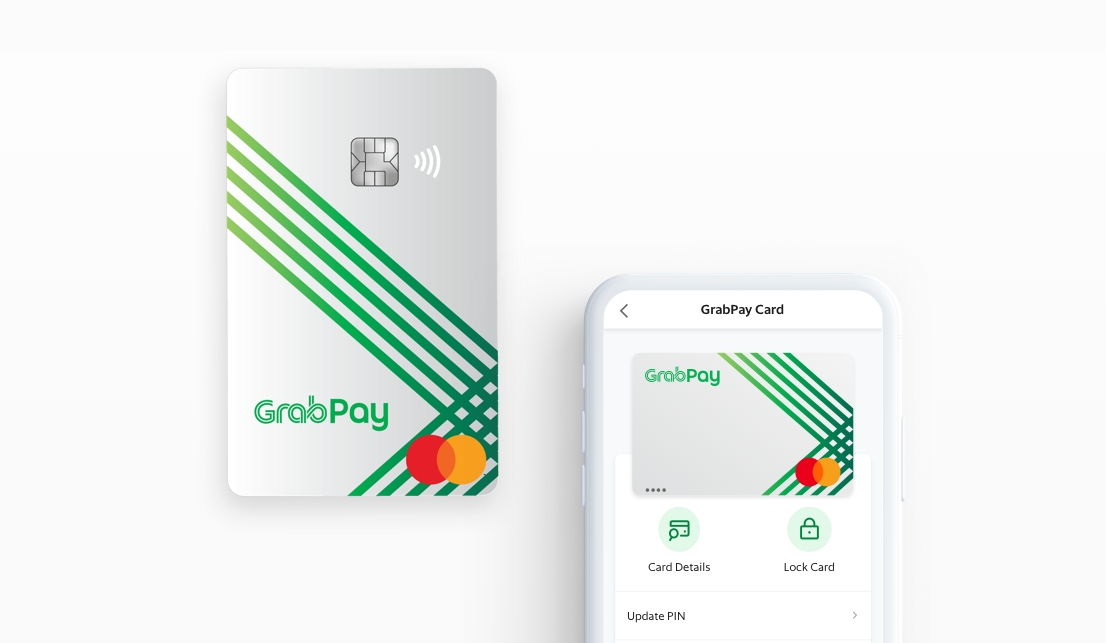

Singapore-based ride-hailing giant Grab on Wednesday launched a digital-first prepaid card in the Philippines under its existing partnership with Mastercard.

Regulated by the central bank of the Philippines (BSP), the GrabPay digital card can be used to make purchases online, to pay for digital subscriptions, and make local and global transactions. It expands Grab’s online merchant ecosystem, adding support for global vendors that accept Mastercard.

The GrabPay card was first launched in Singapore in December last year.

In 2018, Grab and Mastercard formed a partnership to play into Southeast Asia’s increasing adoption of cashless payment options and support the region’s underbanked and unbanked individuals.

According to a survey conducted in April by Mastercard in the Philippines, roughly 40% of Filipino consumers are now using contactless payments more often in light of the COVID-19 pandemic.

Citing data from BSP, local media Philstar reported that a total of 8.4 million transactions cumulatively worth PHP 43.4 billion (USD 865 million) were coursed through the central bank’s money transfer facility from April 1 through April 24 this year. The transaction volume already exceeded the 6.8 million posted in the month prior.

“As cities slowly get back on their feet after months of lockdown brought about by the COVID-19 pandemic, digital payments become the critical enabler to embrace this new reality,” said GrabPay Philippines head Jonny Bates.

Cash-lite in the Philippines

The Philippines’ Land Transportation Franchising and Regulatory Board (LTFRB) is pushing to mandate cashless payments for taxis and transport network vehicle services like Grab as Metro Manila eases into a new normal.

The LTFRB chair said that the need to go cashless in the transportation industry has become urgent as the government continues to strive to mitigate the spread of the virus.

In 2015, the country began promoting the adoption of cashless payments. The initiative, which was part of a bilateral agreement between the Philippine and US governments, aims to turn the country into a “cash-lite” economy within 20 years.