Traditionally, consumer surveys have been a very manual process, with one-on-one interviews at people’s doorsteps, paper-based via mail, or over the phone. They have been the norm in Indonesia until last year, when the pandemic also digitized this industry. Three-year-old market research platform Populix, which collects data via its app, benefited from that.

The startup announced on Thursday that it raised USD 1.2 million in its pre-Series A funding round led by Intudo Ventures, with participation from new investor Quest Ventures and others. With the fresh capital, Populix plans to roll out new products and expand its team.

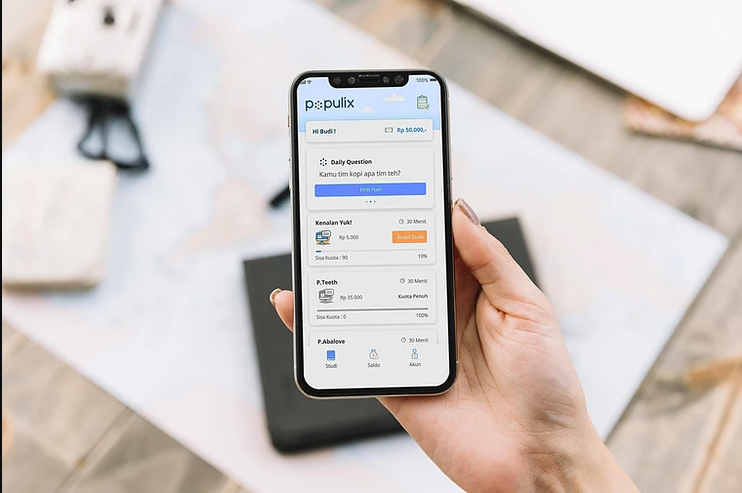

Consumers who like to share their opinions can sign up on the firm’s app or website and become a paid respondent. They will have to share their age, gender, income level, hobbies, and interests for the platform to decide what type of surveys are suitable for a respondent.

“We have an end-to-end quality assurance system to ensure respondents are qualified. During the signup process, we ask them to upload their ID card and the system will verify it with the government database to prevent ballot stuffing,” said co-founder and COO Eileen Kamtawijoyo. The system can further detect consistency in the responses based on past responding activities. An algorithm calculates a score that defines which respondents will be prioritized. Populix has signed up over 250,000 participants from 300 cities in Indonesia for its panel, said Kamtawijoyo.

The startup has a wide range of customers, from tech firms like Tokopedia and Tiket, to large enterprises and universities, such as Sinarmas and the University of Cambridge, as well as SMEs and independent researchers. Kamtawijoyo said that while large firms have the capabilities to collect data from customers, they still need to work with third parties for more holistic data.

“The bigger the company, the more sophisticated their research needs become, and the more types of data they need to see, in order to make sense of shifts in the market,” said Kamtawijoyo. “Therefore, while internal data can be beneficial as a snapshot, they can’t just rely on this and would need our services.” Kamtawijoyo explained that for brand health checks, they will need competitor data for specific metrics and also consumer trends.

For its larger clients, Populix offers subscription-based and tailored services, including brand and customer satisfaction analysis, perception audits, and customized research campaigns. For SMEs, it has self-service research tools. “SMEs or small startups can choose from our research templates and select respondent criteria on our platform. They can also monitor results in real time and download the tabulated data in a dashboard within three days,” said Kamtawijoyo.

In 2020, the firm experienced 5x revenue growth and signed up 52 new enterprise clients from ten countries. SMEs pay around USD 200, while the average project size for enterprise clients can reach USD 20,000, according to Kamtawijoyo. She added that clients are very satisfied, with 56% coming back for another project within six months.