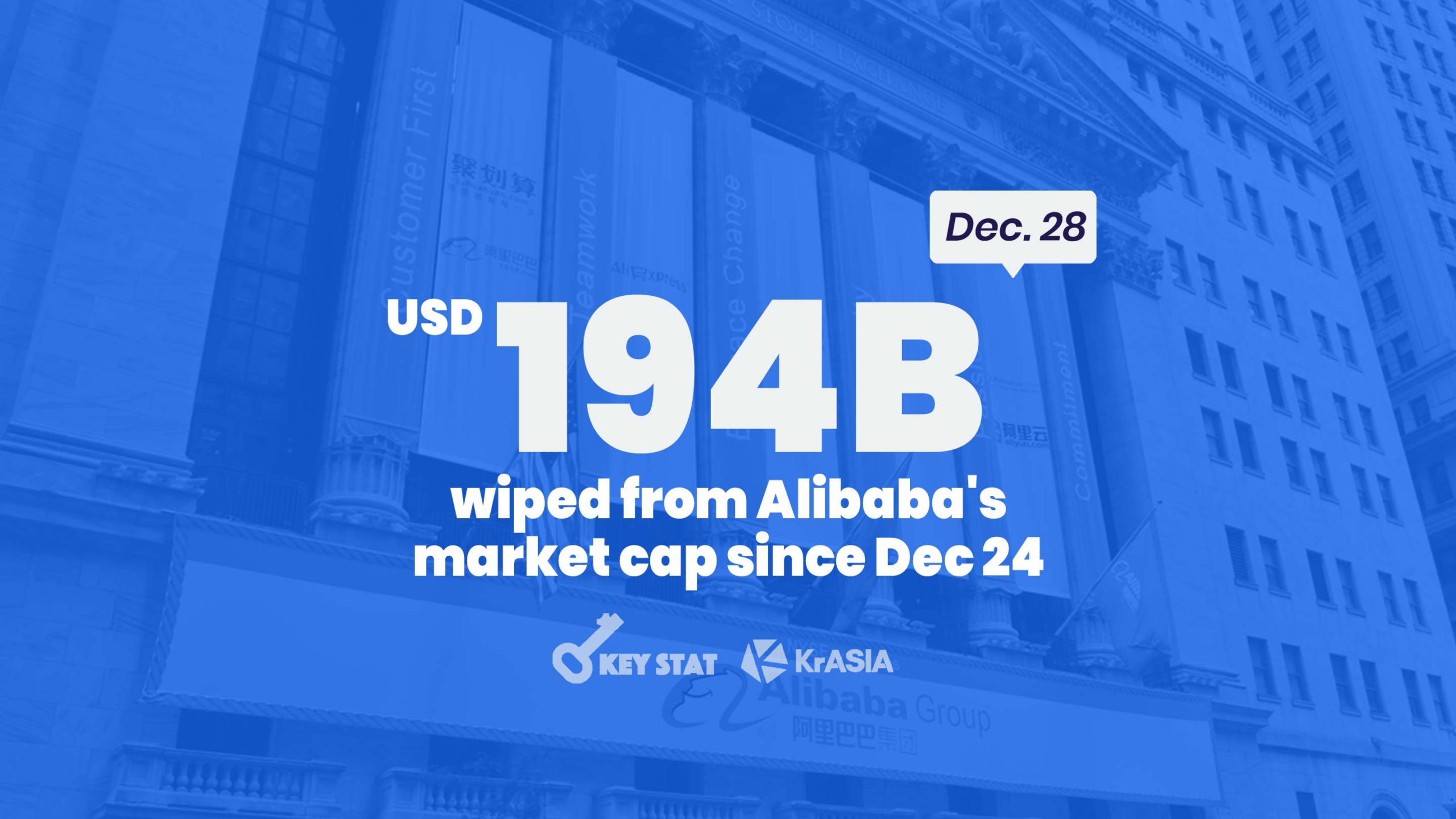

Around USD 194 billion in market cap was wiped out from Alibaba’s stocks (NYSE: BABA; HKEX: 9988) in New York and Hong Kong from their peaks before Christmas. Investor confidence is shaken as Chinese regulators examine the monopolistic behaviors of the e-commerce powerhouse and its fintech affiliate, Ant Group.

Alibaba closed at USD 222 per share on December 24 in New York, down 13% from the day before, in its biggest single-day drop since the company went public in 2014.

On the other side of the globe, Alibaba’s share price sank 14.5% on Monday before the lunch break in Hong Kong compared to December 23, shaving off some HKD 784 billion (USD 101 billion) from the company’s books.

Over the weekend, Chinese authorities told Ant Group to return to its role as a payment service provider. Last month, the stock exchanges of Shanghai and Hong Kong paused Ant’s dual listing, which was expected to pull in USD 34.5 billion from investors.

Last Thursday, China’s State Administration for Market Regulation launched an investigation into Alibaba’s alleged monopolistic practices. Beijing is tightening oversight of the country’s influential technology companies.

Read this: Chinese regulators order Ant group to ‘rectify’ business, return to ‘payment roots’

This article is part of KrASIA’s “Key Stat” series, where KrASIA picks and presents the most significant figures of the day’s technology and business world.