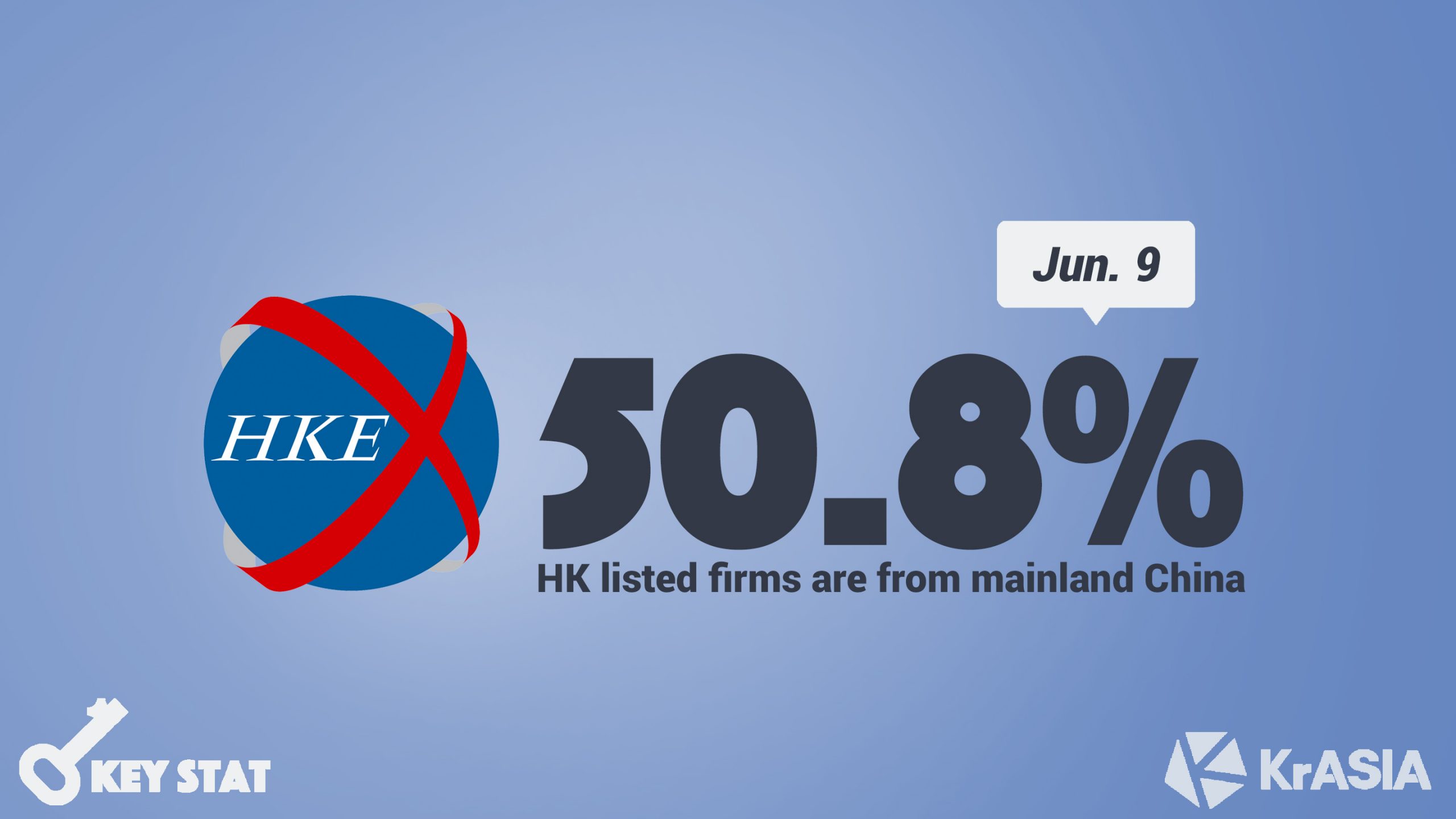

More than half of the companies currently listed on the Hong Kong Stock Exchange (HKEX) were from the mainland, according to May 2020 data from the exchange. At the same time, the 1,261 mainland China-oriented enterprises made up 76.9% of the bourse’s total market cap.

Mainland China has been the biggest source of public offerings for the HKEX in recent years. The number of H shares, Red chips Stocks, and Mainland private enterprises combined has occupied a steady 50%-51% share of the bourse’s total number of companies listed since May 2018, the earliest data available.

Meanwhile, the capital raised by these mainland companies has grown to today’s three-thirds of the bourse’s total market cap from the 67% of May 2018.

While affected by the COVID-19 pandemic in the first quarter, the HKEX is expected to continue benefiting from mainland IPOs in 2020, as China firms queue for domestic listings amid an unfriendly capital environment in the US.

It is believed that about 50 to 60 US-listed Chinese companies will return to either the Shanghai or Hong Kong bourses in the next three to five years, KrASIA reported.

In the first quarter of 2020, the HKEX raised 31% less capital from IPOs than that of 2019, as the global stock market frustrated under the impact of the coronavirus outbreak, according to a Deloitte report.