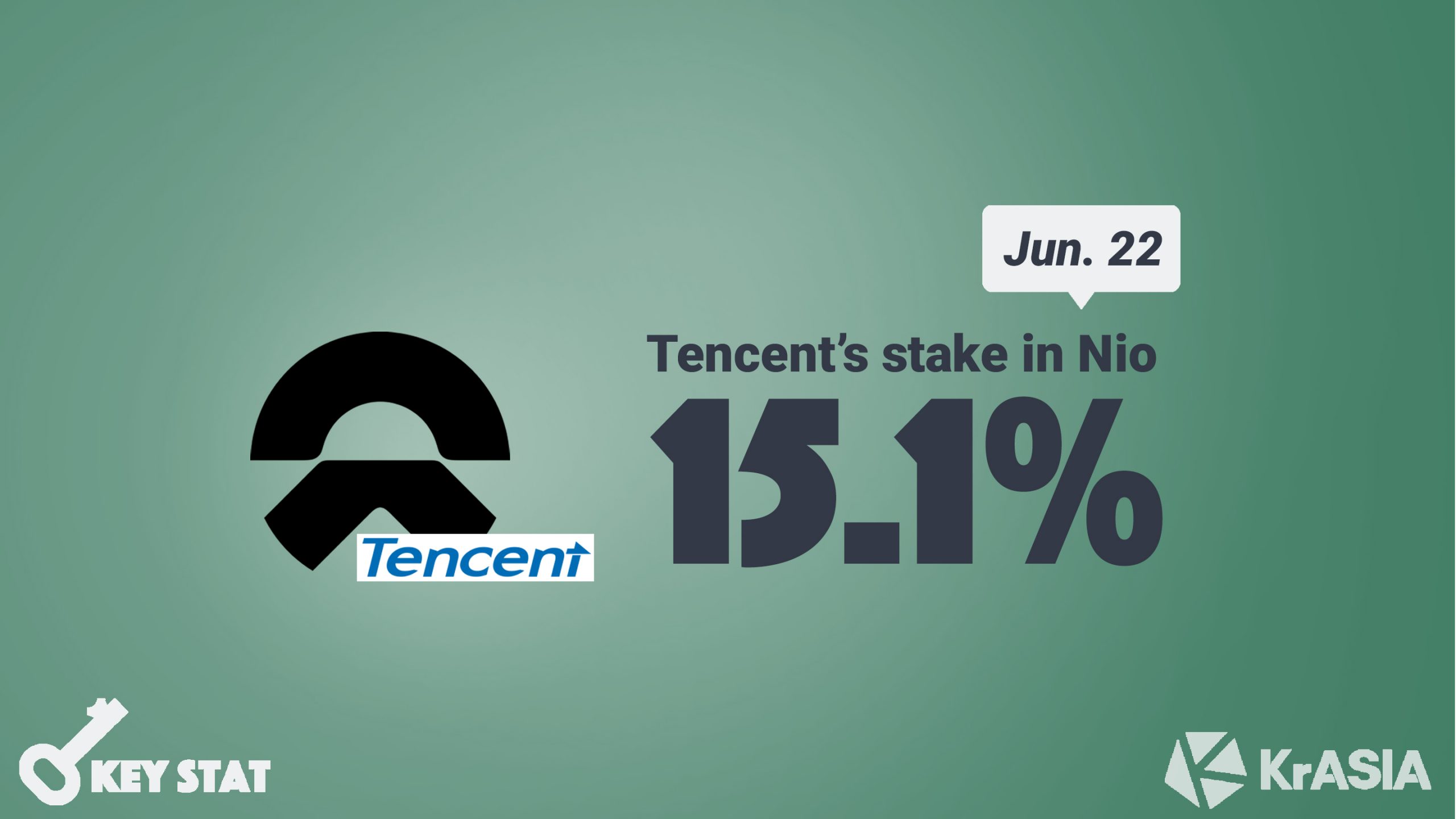

Tencent (HKG: 0700) spent USD 10 million to acquire 1.68 million American depositary shares (ADS) of Chinese electric vehicle (EV) maker Nio (NYSE: NIO), increasing its shareholding to 15.1%, as Nio’s latest SEC filing showed.

Besides shares held directly under its name, the Shenzhen-based social media and entertainment magnate is also the ultimate beneficial owner of another 16% of Nio’s ADSs through three of its wholly-owned subsidiaries.

Tencent is the second-largest shareholder by voting rights of Shanghai-based Nio after its founder Li Bin, who holds 13.8% of the shares and 47% of the voting rights as per the company’s March 2020 filing.

Boosted by the news, Nio’s share price rose 2.23% to USD 7.34 by the close of trading on June 19, bringing its total market value to USD 8.7 billion.

Thanks to strong sales since April, the company was able to offset the negative impact of its disappointing first quarter, selling 68% more EVs from January to May than the same period in 2019. Nio’s success stood out amid an industry downturn as China’s overall EV market suffered from the COVID-19 outbreak, with sales declining more than 33% compared to 2019.

Earlier this month, Nio increased the number of shares on offer to 72 million ADRs, from 60 million, raising USD 428.4 million in what might signal a turnaround in investors’ sentiment towards the loss-making startup.

With its newest automobiles priced almost on par with Tesla, Nio is considered a premium EV brand in China. After rapid growth in 2018, the NYSE-listed company announced in last December’s quarterly report that its cash balance was not adequate for continuing operations during 2020, hence the need to raise further capital.

In 2020 Q1, Nio reported 50% quarter-on-quarter declines in both the total revenues and vehicle sales, while net loss narrowed to USD 238.9 million thanks to a series of fundraising moves.

In the last quarter of 2019, Hillhouse Capital, which had been Nio’s third-largest investor and backed the company since its Series A fundraising, sold all of its shares.