Dubai-based investment advisory platform Sarwa is expanding to Saudi Arabia after receiving a fintech experimental permit from Saudi’s Capital Markets Authority (CMA), the company said in a statement. The development comes almost a year after Sarwa raised USD 8.4 million in one of the largest funding rounds for a consumer fintech platform in the region.

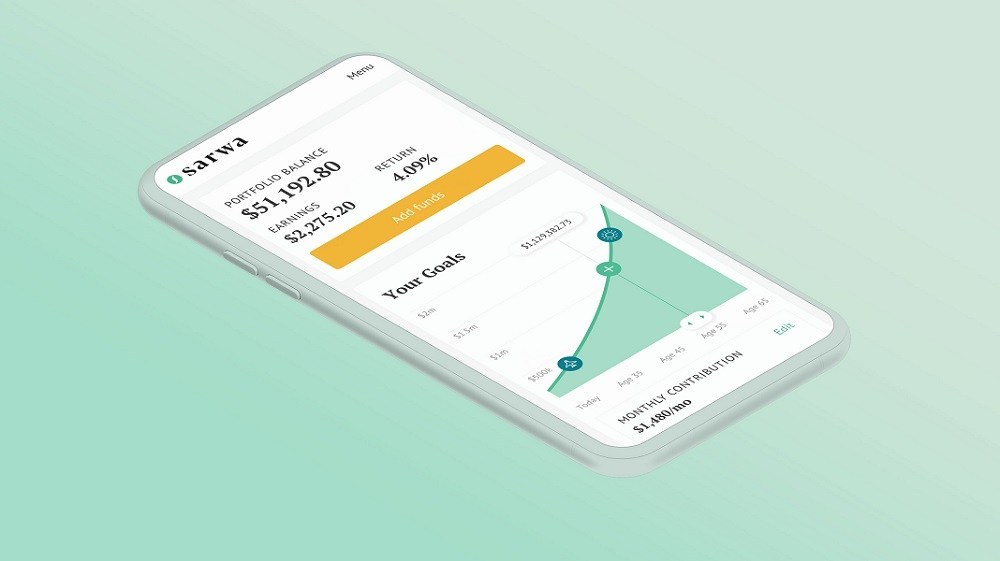

The startup uses a combination of technology and human advice to enable users to invest their savings in low-cost index funds. With the expansion to Saudi Arabia, it will enable both locals and expats to use its platform to make investments. The users receive a recommended portfolio on Sarwa based on their goals and risk appetite. They can open an account on the platform in a few minutes and begin investing for what the startup says is a very low fee.

As this is an experimental permit, the services will be limited to a small number of users in Saudi Arabia for now.

Mark Chahwan, the co-founder and CEO of Sarwa, said, “As founders from the region, our mission is to make smart financial services accessible and affordable to everyone here. There are so many people in the Middle East who do not have the tools nor the know-how to start their investing journey and work to better their future. They do not have access to the right low-cost advice that can help them build wealth properly, and specifically first-time investors.”

“When we received the call that we got the license, we were very excited to introduce Saudi to Sarwa and to long-term, simple, affordable, and smart investments that we are all about,” Chahwan said.

The Dubai-based fintech includes Saudi VCs among its investors, including Hala Ventures and Vision Ventures.

Ali Abussaud, founding managing partner of Hala Ventures, said, “Since the establishment of Sarwa, expansion to the Saudi market has been an important milestone. Now with this being achieved, we are delighted to present to Saudis their trusted robo-advisor. Sarwa will help clients in Saudi plan, invest, and manage their investments as easy as a click of a button.”

Kais Al Essa, founding partner and CEO of Vision Ventures, said, “Investing for your future retirement or for your kids future is a critical financial planning step. Such planning is, unfortunately, weak in general in the region and in Saudi Arabia. I am thrilled to see Sarwa get approval to be available in the Saudi market as a new automated financial tool for everyone to use.”

Sarwa also enables users to invest in a halal portfolio. According to its website, this consists of a globally diversified portfolio of BlackRock index funds that exclude companies profiting from industries that contradict Islamic values, such as alcohol, gambling, tobacco, pork, and loan interest.

New York-headquartered shariah-compliant robo-advisory platform Wahed is another player that is eyeing the Saudi market. It raised USD 25 million in a round led by Saudi Aramco Entrepreneurship Ventures (Wa’ed Venture) and BECO Capital.