High Output Ventures, a Singapore-based venture studio, has launched an early-stage fund to invest in Pakistani startups, the firm told MENAbytes. The fund is setting up an accelerator program called HOV Accelerate that will connect Pakistani entrepreneurs with global mentors and provide them with the money to scale their companies. HOV is not disclosing the size of the fund and names of its limited partners for now, but has told MENAbytes that it is ready to deploy the capital through its accelerator program right away.

Pakistan already has many accelerators and incubators, some of which are running their programs with the help of government grants, but almost none offer the kind of capital a startup would need if it were to have a decent runway before turning to other investors. That’s the gap HOV Accelerator wants to fill. The investor says that it wants to build something similar to Y Combinator for Pakistani startups.

Usman Sheikh, the managing director of HOV who is originally from Pakistan, has built, led, and sold various technology companies over the last 15 years, and now wants to use his experience, network, and the team he has built to help Pakistani founders build great companies.

Sheikh, who has also invested as an angel in some startups across the world, commented on the launch of High Output Ventures in Pakistan and said, “We feel Pakistan’s market, as well as its founders, has great potential, particularly in the early stage where we see founders with a lot of grit and determination building good companies with very limited resources. Our job is to help these founders take their startups and themselves to the next level. We want to help repair the pipeline for downstream investors by churning out high quality, polished companies.”

Read this: Talent investor People Equity Fund raises USD 12.5 million for founders in Morocco, Algeria, Pakistan, and Bangladesh

HOV Accelerate will invest USD 50,000 in 20 Pakistani startups spread across two cohorts, with the first one expected to start in October. It is a sector-agnostic program that will connect the selected startups with global domain experts based on their needs in what it says will be a bespoke model.

Omar Parvez Khan, a partner with High Output Ventures, spoke to MENAbytes about their unique selling proposition in addition to the capital they offer. He explained that their experts will work individually with each startup and keep an eye on their progress. “At the start of the program, they’ll do an audit of the startups around their expertise (for example, marketing) and create a dedicated strategy for each one of them with individual KPIs. Every company is different and using this approach means that the curriculum of the program gets tailored for each one of them instead of everyone just getting the same guidelines,” Khan said.

He also explained that the modules of the program will include product design, finance, legal, and a few others. The program will also feature some additional lectures and workshops. “The main value is basically giving each company free, top-quality consultants,” said Khan.

The investment will be made in two tranches, the first one being USD 25,000 that will be given to every selected startup at the start of the program, and the second one being USD 20,000 or USD 30,000 that will be given to the startups at the end of the program, depending on their performance.

They are not completely transparent regarding the equity they’ll take from the startups. “Due to the diversity of applications ranging from early-stage startups to more established companies, we are not standardizing our equity terms. The equity percentage will be a discussion that we will have with startups who have reached the final stage of the application process,” the firm’s website notes.

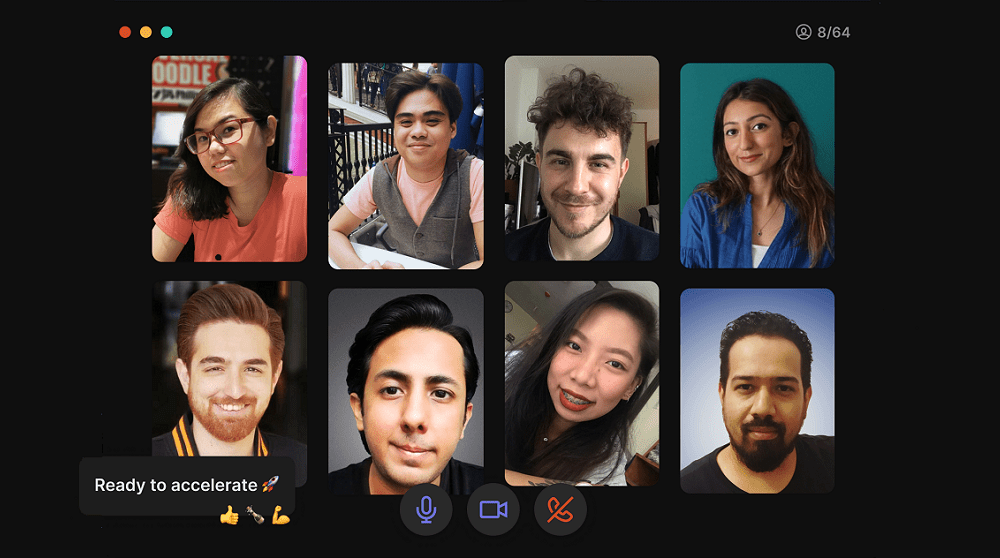

HOV will help the startups that will take part in its accelerator program with market segmentation, building the team, attracting investors, as well as generating and maintaining momentum. The entire program will be run remotely.

The accelerator is currently accepting applications for its first cohort.