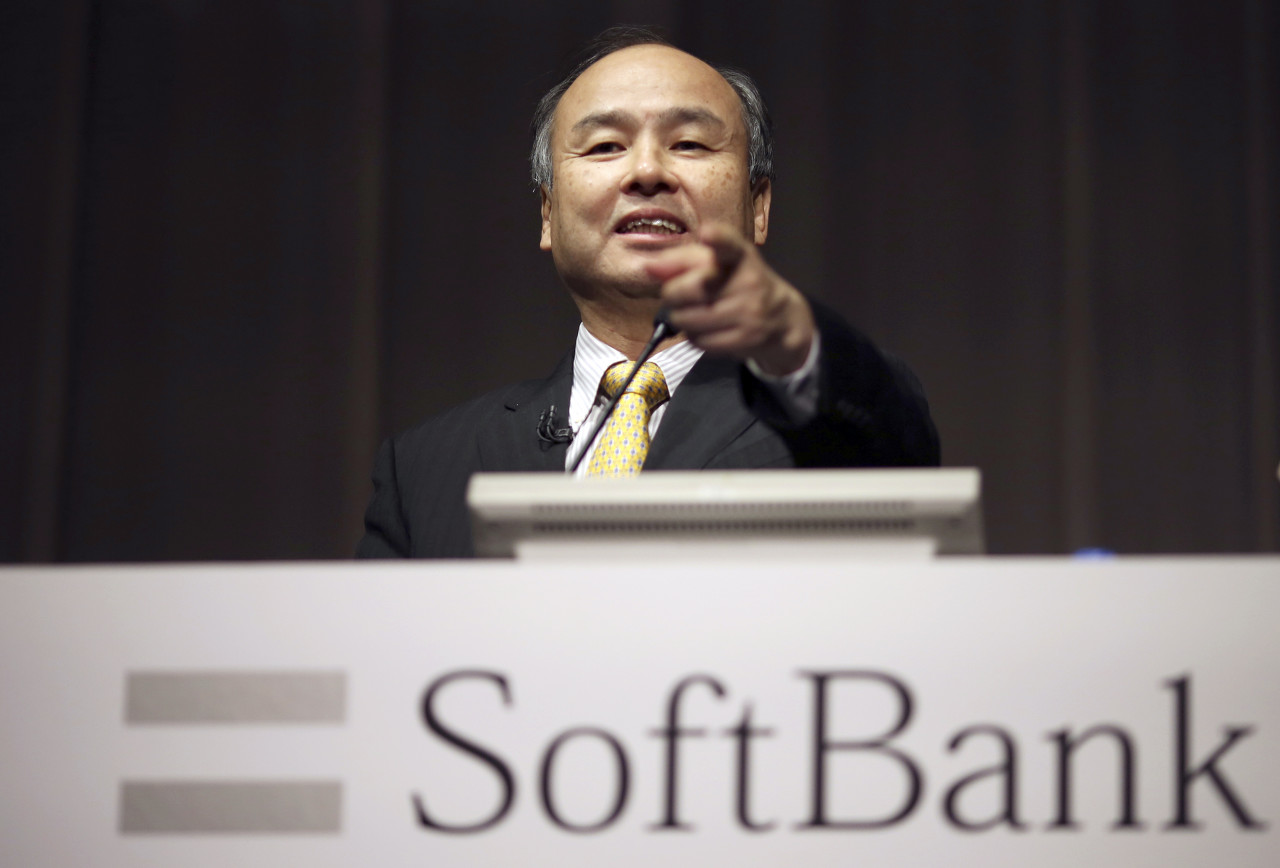

SoftBank Group chairman and CEO Masayoshi Son on Thursday laid out a defensive strategy to help the company weather its biggest ever quarterly loss, vowing to scale back new investments in the face of a sell-off in tech stocks.

The Japanese investment group reported a net loss of JPY 2.1 trillion (USD 16.2 billion) for the January-March quarter, as a flight from technology stocks dented the valuations of its global portfolio. The loss marks a dramatic swing in fortunes from a year earlier, when the company posted a JPY 1.9 trillion quarterly profit.

Its net loss for the full fiscal year that ended in March also came to a record JPY 1.7 trillion, a reversal from its all-time-high JPY 5 trillion profit a year before.

Some of the biggest bets made by SoftBank through its near USD 100 billion Vision Fund, the world’s largest technology investment fund, and its USD 56 billion successor came under pressure during the quarter as rising interest rates and political uncertainty drove capital out of risky assets.

SoftBank adjusts the value of its holdings in portfolio companies on a quarterly basis and books gains and losses in its financial statement even if they are unrealized.

SoftBank also wrote down JPY 944 billion in “uncollectable” loans it made to SB Northstar, a subsidiary that bought publicly listed tech stocks and derivatives tied to them, because it has “incurred significant investment losses.” Of the total, JPY 315 billion will be personally covered by Son, who owns 33% of Northstar.

“The action we need to take now is a thorough defense,” Son said in a news conference. “Take an umbrella when it rains.”

Son said investments by the twin Vision Funds and others have already plunged to USD 2.5 billion in the fourth quarter of the financial year from USD 20.9 billion in the first quarter. “Compared to the past year, the amount of investment will be halved or less,” he said.

Son was particularly bearish on China, where he previously made a fortune through an early bet on e-commerce giant Alibaba Group Holding. Alibaba’s shares have plummeted more than 60% over the past year amid a regulatory crackdown on tech giants.

SoftBank invested more than USD 12 billion in Chinese ride-hailing company Didi Global before it was hit with a regulatory backlash for pushing ahead with a US listing. Its shares fell by half from January through March.

“New investment in China is decreasing and the risks of new investments must be carefully considered. It is not zero. There are great companies, but they will be small deals,” Son said.

Other parts of its portfolio have also been hit hard. The stock price of Coupang, South Korea’s big e-commerce player, fell by 40% during the same period, while Singapore-based Grab and India’s Paytm dropped by 51% and 60%, respectively.

Many of these shares have continued to decline through April and May. As tech valuations fall, SoftBank has been investing smaller amounts of capital. In late April, it led a USD 70 million investment in AI Medical Service, a Japanese biotech startup.

Son said he expects fewer companies from SoftBank’s portfolio to go public this year but remained optimistic about UK chip designer Arm, which he plans to take public by March 2023. He said the biggest challenge for its listing, a revolt by the former head of Arm’s Chinese joint venture, was finally resolved after successfully installing two new co-CEOs.

SoftBank will maintain a majority stake in Arm after the listing, he added.

Losses from the two Vision Funds were partly offset by profits from its Japanese mobile arm, SoftBank Corp., and Arm.

SoftBank shares fell 8% on Thursday ahead of the results amid a broad market sell-off. They extended losses in after hours trading.

This article first appeared on Nikkei Asia. It has been republished here as part of 36Kr’s ongoing partnership with Nikkei.