Taiwan’s leading provider of electronic components plans to expand its production capacity across Asia despite flagging the possibility of a near-term dip in demand, as the company bets on the emergence of parts-hungry tech like 5G and electric vehicles to drive growth for years to come.

Chiao Yu-heng, chairman and CEO of Passive System Alliance, told Nikkei Asia in an interview that PSA already has 40 production sites across China, Japan, Malaysia, and its home market. This diversified production footprint, Chiao said, has helped mitigate the impact of COVID-19 and geopolitical disruptions, as well as unexpected power restrictions in China.

Now, the company is looking to further expand at home, in Malaysia, and in China to address growing electronics parts demand ahead for electric cars, 5G infrastructure, mass transportation, as well as satellites and aerospace.

“For our [printed circuit board] business, we will increase next year about 20% in Malaysia, 10% in Taiwan, and also up to 20% in Chongqing,” Chiao said, adding that the Chinese city has been less impacted from the recent power restrictions in the country.

PSA will also “de-bottleneck,” or improve efficiency of, production at its five manufacturing locations in Japan to increase their capacity, he added.

“China is still a very important manufacturing base as its domestic demand is big, the government is efficient, and the supply chain is complete,” Chiao said. “But our clients want to have more flexibility.”

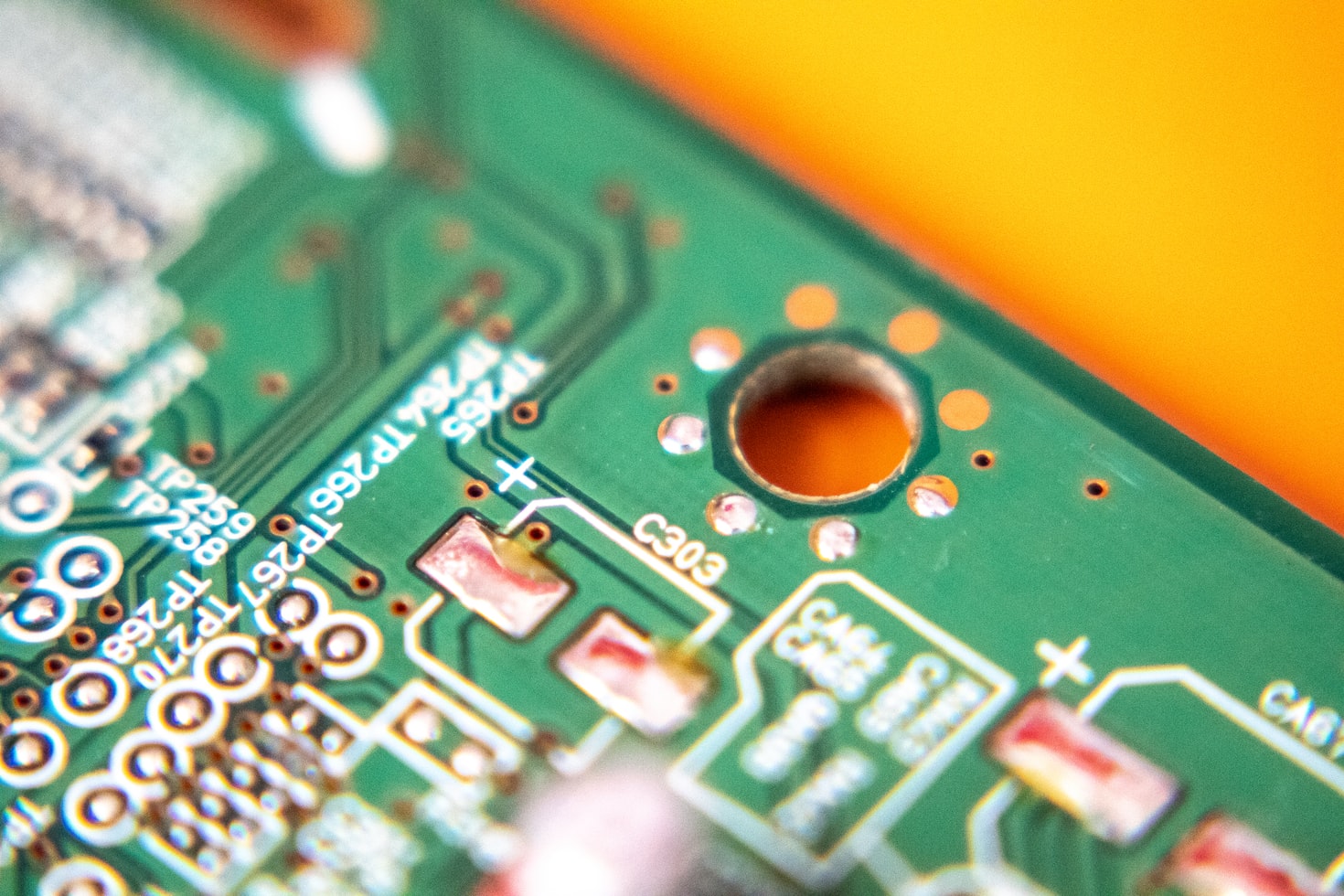

PSA’s plan for so-called passive components, including those used in automobiles, is to expand mainly in southern Taiwan. Passive components are essential parts in electronic devices that do not generate power. Instead, they dissipate, store, or release it.

The chairman warned, however, that the demand outlook after the Christmas holiday is uncertain.

“Inflation could be a big issue,” Chiao said, adding that his company already saw increasing costs for materials, wages, logistics, paper, and electricity. “Currently we don’t see the demand outlook change much, but after the Christmas holidays, consumer demand could slow if there’s inflation and if major central banks started to hike interest rates. … There’s indeed a possibility of correction later.”

Chiao said supply chains are facing unprecedented challenges, including the severe shortages of semiconductors and components, COVID-19 disruptions in Malaysia and other Southeast Asian countries, and sudden power restrictions in China, the world’s manufacturing powerhouse. For PSA, the impact from these power restrictions is still manageable, affecting roughly 5% of the company’s output, the chairman said.

The effect of the supply chain disruption on consumers is also still fairly mild, he said. “Consumers buying goods and electronic devices may have fewer options compared with in the past, when there were no such disruptions in the supply chain. It’s like if you want a specific type of coffee but can’t get it as easily as before. You may need to wait in line for that specific coffee, or you could look for alternatives, like having tea instead. It’s not yet to the point that you can’t buy anything.”

Chiao said PSA is able to help customers mitigate the supply chain disruptions thanks to its network of manufacturing bases spread across several markets. But for any suppliers that are only now starting to think about diversifying production, it will be “almost impossible” to quickly build new capacity.

“Building new factories is not like moving house. It takes time and money and a thorough evaluation of the locations. Given the on-and-off COVID-19 outbreaks, I would say it takes at least five years if you want to build a new plant overseas now,” the chairman said. “The construction cost, including land, cement and steel prices, has also increased significantly.”

PSA is a business group formed by 11 electronics components and materials companies, many of which are listed and count Chiao as their chairman. It has a wide-ranging portfolio of products including passive components, circuit protection components, printed circuit boards, antennas, and chip resistors. These parts go into everything from smartphones and game consoles to data centers, automobiles, and satellites. Demand for these components and parts has been spurred by the booming EV industry as well as the introduction of 5G wireless technologies, from base stations to end-user devices like smartphones, as these need far more components than their 4G counterparts do.

A 5G smartphone, for example, has more than 1,000 passive components compared with the 500 to 900 used in a 4G handset, while 20,000 to 30,000 passive components go into an EV—up to five times more than a conventionally powered car with advanced driver assistance systems.

PSA has grown over years by acquiring stakes in various electronics components makers including Japan’s Kamaya, ELNA, and Nitsuko Electronics. PSA also raised its stake in Taiwan’s mechanical parts design and manufacturer Silitech Technology to 25% this year through PSA’s Walsin Technology, the world’s No. 4 passive components supplier, making it the largest single shareholder of the Taiwanese automotive parts supplier. PSA has nearly 40,000 employees worldwide, and Chiao said his company is looking to collaborate with more Japanese suppliers to offer a wider range of products and together expand the global market.

This article first appeared on Nikkei Asia. It’s republished here as part of 36Kr’s ongoing partnership with Nikkei.