Similar to last year’s funding deluge in edtech companies due to the unprecedented rise in the adoption of online learning during COVID-19-induced lockdown, investors continue to write checks for edtech startups as India struggles with the second wave of novel coronavirus in 2021.

Mumbai-based higher education startup upGrad, which offers upskilling courses for students and working professionals, said Monday it has raised USD 120 million from Singapore-headquartered Temasek.

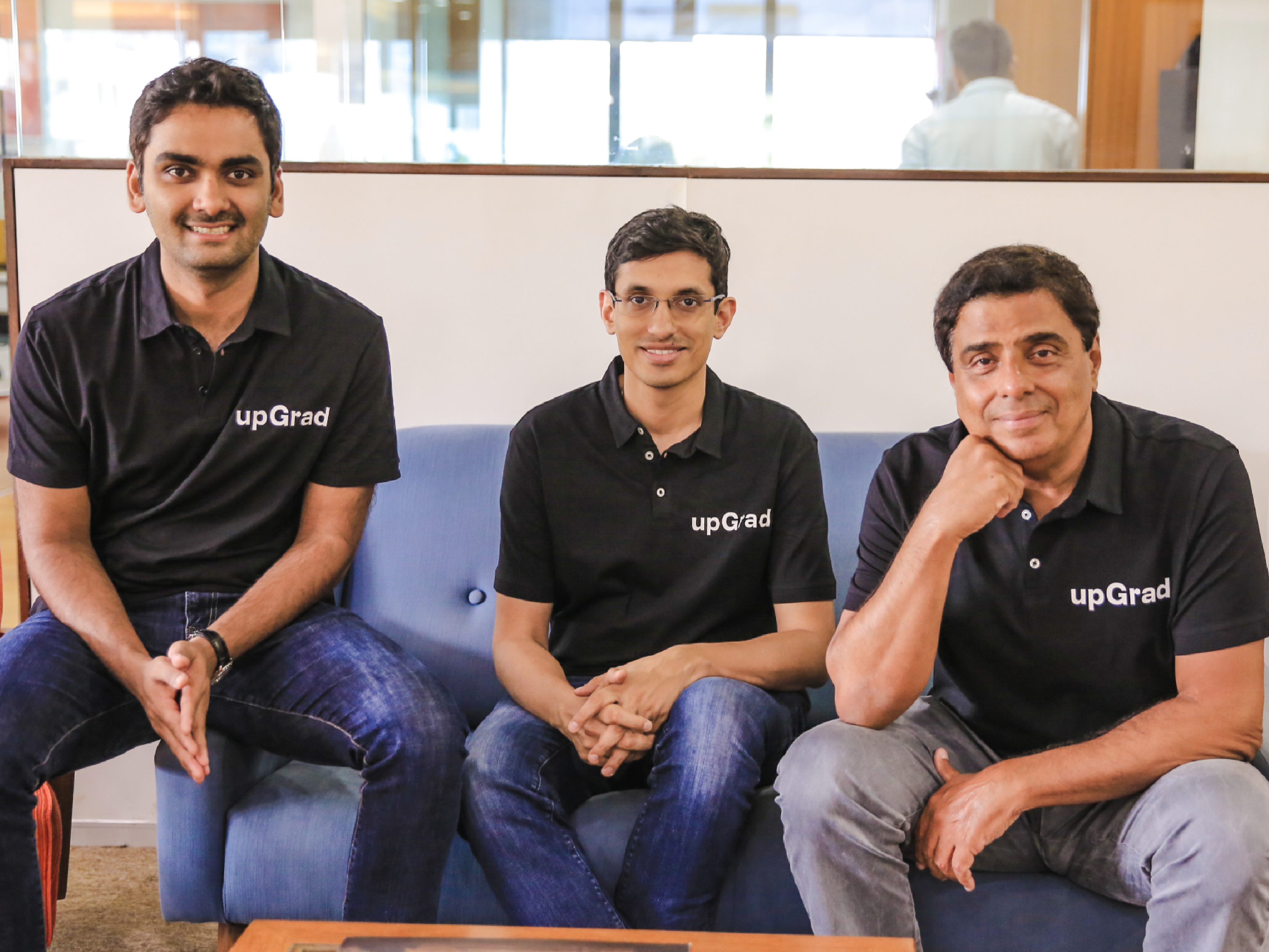

Founded in 2015 by veteran entrepreneur Ronnie Screwvala, Mayank Kumar, and Phalgun Kompalli, upGrad had been bootstrapped by the co-founders so far. This is the first venture capital raised by the edtech major.

The Mumbai-based firm said it plans to use the fresh capital to further strengthen its team, bolster its technology and product capabilities, pursue mergers and acquisitions (M&A) opportunities, expand its graduate and post-graduate degree portfolio in India, and scale its operations globally.

In the last six months, the edtech firm has established a ground presence in the Asia-Pacific region, a report by local media

Read this: A new breed of edtech startups are growing in India as schools look for tech solutions

The company also aims to scale up its operations to achieve USD 2 billion revenue mark by 2026, it said. Currently, its annual revenue run rate reportedly stands at USD 165 million.

“This capital will further fuel our commitment towards global expansion as well as deeper India penetration, as we march forward with our goal of making India the teaching capital of the world,” the co-founders said in a joint statement.

Screwvala in an interview with Bloomberg said he expects to raise another round of capital in three to six months.

According to a report by PGA Labs and IVCA (Indian Private Equity & Venture Capital Association), Indian edtech companies received USD 2.2 billion in VC funding in 2020 on the back of the meteoric rise in online learning as schools remained shut for the large part of the year. However, there were concerns of users’ stickiness once schools and colleges reopen in 2021. But as the country is going through the second wave of COVID-19 and educational institutes keep conducting online classes, edtech companies have nothing to fear.

VC money in edtech startups continues to flow. According to the data collated by research firm Venture Intelligence, Indian edtech startups raised USD 616 million in the first quarter of 2021. The trend has picked up pace this quarter with various states announcing curfews and lockdowns to curb the number of new cases.

Aside from upGrad, educational technology startup Lead School, which helps digitize private schools, has just raised USD 30 million in a Series D funding round led by Silicon Valley-based GSV Venture. Existing investor WestBridge Capital also participated in the round.

“Our goal is to continue to reach more schools and students,” said Sumeet Mehta, CEO and co-founder of Lead School in an interview with ET.

Prior to this, the company had received USD 28 million check from WestBridge Capital and Elevar Equity, last August. The eight-year-old company was co-founded by Mehta and Smita Deorah to enhance the offerings of private schools in lower-tier towns using technology. It provides its own educational content for students and teaching resources for teachers to private schools. School administrators use its tool to assess teachers’ performance in the class as well as monitor the progress of students. Even parents can use its platform to track their children’s learning curve.

Earlier this month, edtech startup Vidyakul raised USD 500,000 in a seed funding round led by JITO Angel Network along with participation from We Founder Circle and SOSV. The startup offers live lectures and pre-recorded courses, study notes, online tests, and sample papers for Class 9–12 in regional languages. The company plans to use the fresh funding to create educational content for Hindi and Gujarat state board students.

Edtech decacorn Byju’s also raised over USD 1 billion from Facebook co-founder Eduardo Saverin’s B Capital Group, Baron Funds, and US-based investment hedge fund XN Exponent Holding in its ongoing Series F round, as per the regulatory filings.