Tencent, China’s social networking and gaming behemoth, is making a bet on China’s short-video streaming industry. The Shenzhen-based company is reportedly giving out subsidies worth RMB 3 billion (almost $ 478 million) to influencers to entice them over to its short video platform Wei Shi, locking horns with Toutiao‘s video-streaming unit Tik Tok.

The WeChat operator has shown its hostility towards China’s largest news aggregator Toutiao and its subsidiary in short video. Previously in March, WeChat users claimed that they failed to share links from Toutiao and Tik Tok in WeChat Moment.

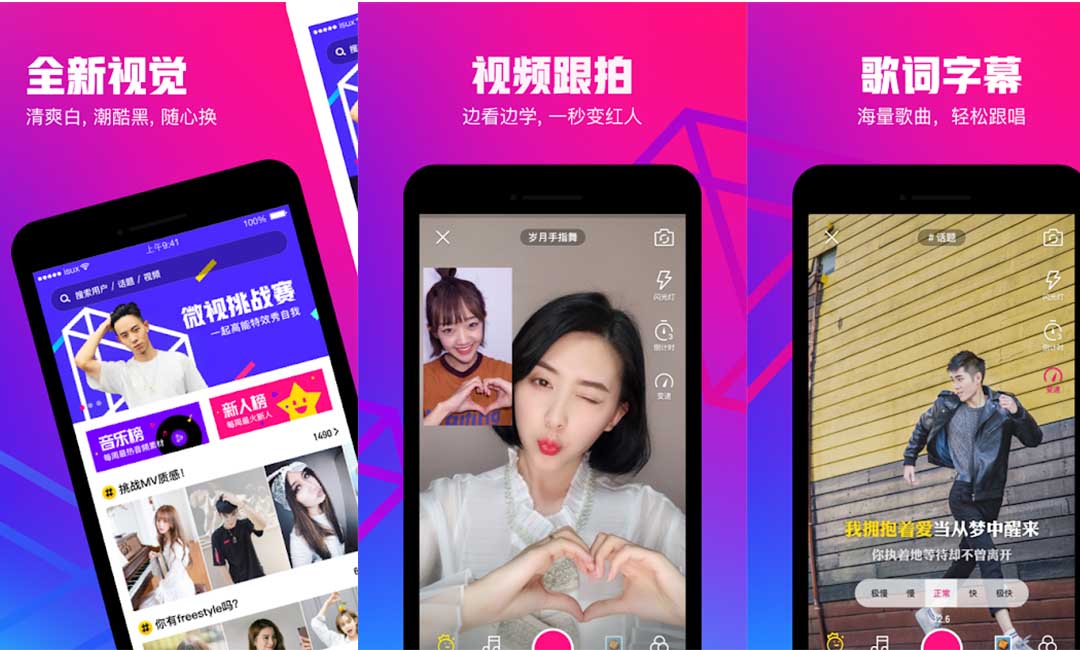

This time, Tencent is relying on its Weishi app, which looks pretty much the same with Tik Tok, to compete with its rival. Weishi had launched in September 2013 and saw its user number surge to 45 million by the Spring Festival in 2014. After that, the app hit a bottleneck and was taken offline in April 2017.

Tencent revived the app in May 2017, but things didn’t get better for the app until February 2018, when Weishi leveraged on a live Trivia game and a dancing game within its app, which is similar to Tik Tok’s “Dancing Machine”. A recent upgrade in April made the app look even more like Tik Tok.

In 2017, the revenue of the short video market in China reached RMB 5.73 billion (around $ 913 million), according to a report by market analysis institute iResearch. In this huge and fast-growing market, Kuaishou, a Tencent investee, ranks the #1 company by MAU. Its monthly active user reached 23o million in February this year according to a report by market intelligence firm QuestMobile. At the same time, Toutiao is an undeniable prominent competitor to Kuaishou in short video-streaming. Its three apps, Tik Tok, Xigua, and Huoshan hold in total almost 336 million monthly active users, according to the same QuestMobile report.

The chance for Weishi to win is through the huge Tencent service ecosystem. For one, Tencent instant messaging app QQ and WeChat can help boost Weishi’s traffic. Apart from that, Tencent-backed Kugo Music, QQ Music, and Kuwo Music are the top three music apps in China by DAU, providing Weishi a large pool of licensed music. This gives the app an advantage over Toutiao’s Tik Tok, as both two apps are heavily relying on music to liven up their content.

Tencent’s worry over the growing Tik Tok, and also the company behind it, doesn’t come from thin air. Toutiao is already China’s largest news aggregator with over 200 million daily active users who spend on average 74 minutes a day on the app. Tik Tok has outperformed WeChat to become the most downloaded app in the iOS App Store.

As users spend more time on Tik Tok, WeChat official accounts, which used to be among the first choices for promotion and ads, is being undermined. Some content makers on WeChat told 36Kr, China’s biztech media and also KrASIA parent company, that their user number is declining, and it’s harder to get views these days.

Short video streaming, apart from being a huge magnet for user traffic, has great potential in monetization when integrating advertisements and e-commerce features in the content. Tik Tok is already exploring the possibilities in linking to Taobao, Alibaba‘s e-commerce platform.

For Toutiao, the biggest problem now is how to keep the growing momentum of Tik Tok, while fighting an increasingly tighter regulation on China’s cyberspace. Beijing regulators just taken its flagship news aggregator offline from local app stores for 3 weeks and permanently shut down its joke app for vulgar content.