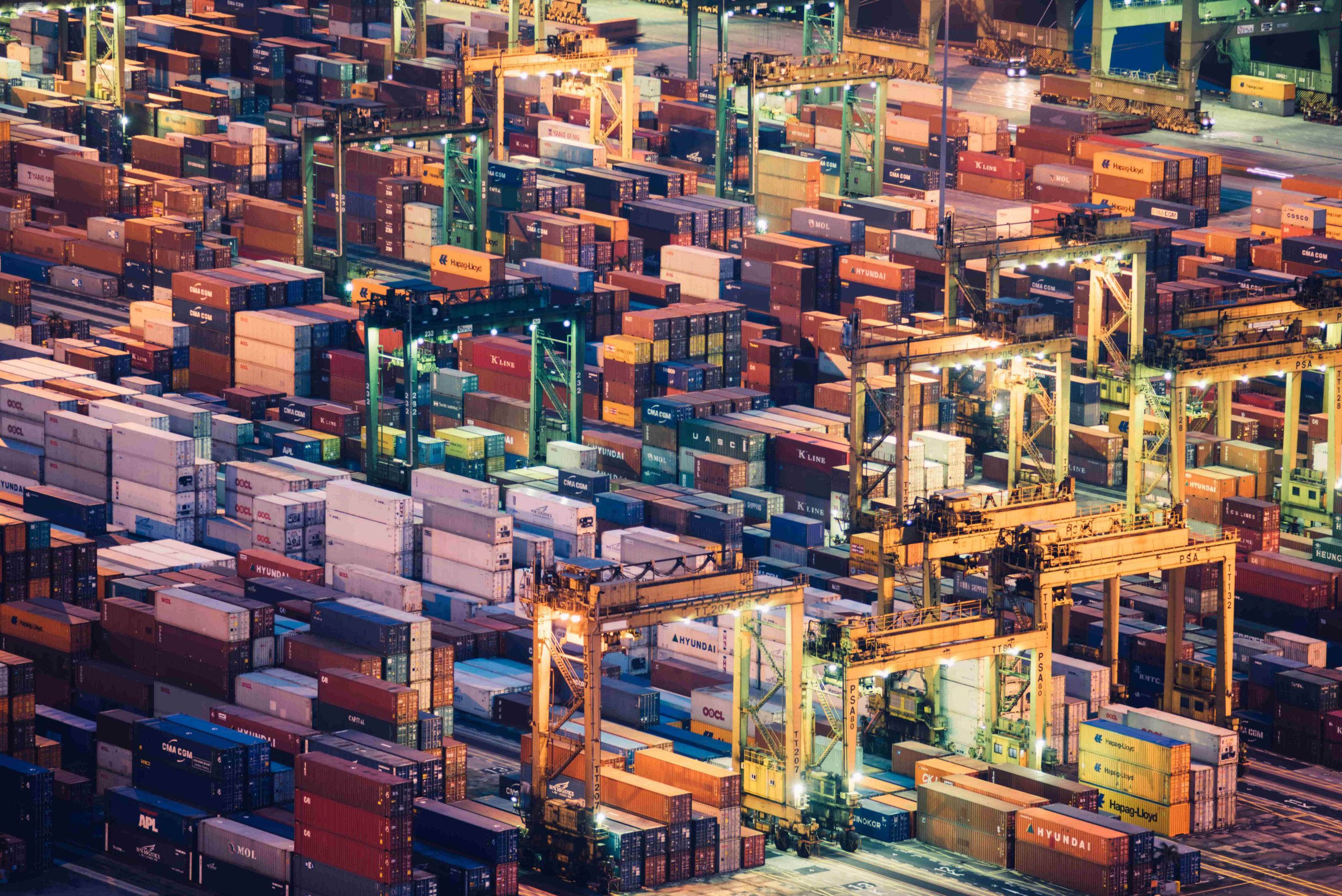

Vietnam’s exports hit a record high in March this year on the back of economic recovery from the COVID-19 pandemic and pent-up demand for manufactured goods.

According to data from the General Department of Vietnam Customs (GDVC), the country’s total value of imports and exports for March 2022 rose 38.1% from the previous month to USD 67.4 billion. In the first quarter of 2022, Vietnam’s exports increased by 13.4% from the previous year to hit USD 89.1 billion while imports reached USD 87.6 billion, up 15.2% year-on-year.

Vietnam’s Ministry of Industry and Trade forecast that the country’s exports will continue to rise, largely driven by the global economic recovery and new free trade agreements.

Notably, in March this year, Vietnam’s exports jumped by 45.5% from the previous month to hit USD 34.1 billion, overtaking Shenzhen’s total export volume of USD 24 billion in the same month.

Home to one of the busiest ports in China, Shenzhen is a global manufacturing powerhouse. But since the COVID-19 pandemic, strict lockdowns have halted production and disrupted business operations, leading to order cancellations and a decline in export growth

These lockdowns have had a significant impact on China’s economy. The country’s utilization rate of national industrial capacity fell 1.4% year-on-year to 75.8% in Q1 2022, according to the National Bureau of Statistics. Over the same period, the utilization rate of manufacturing capacity also dipped by 1.7% to 75.9%.

Besides facing a slowdown in export growth, China has to contend with other domestic issues, including soaring energy prices and rising raw material costs. According to Guan Tao, global chief economist at BOC International (China), multiple challenges lay ahead for China, including rising geopolitical tensions, which could weigh on the country’s external trade and hamper global economic recovery.

As global manufacturers diversify their supply chains and shift production away from China, Vietnam appears to be a beneficiary of this relocation. The country’s manufacturing industry is making a speedy recovery on the back of strong order books, which are expected to keep production lines busy this year.

Vietnam’s aggregated import and export value in Q1 2022 climbed 14.4% year-on-year to USD 176.4 billion, based on data from GDVC.

One sector that has shown strong growth is the textile and garment industry, despite rising logistics costs and labor shortages.

Textile exports hit USD 8.2 billion in the first two months of 2022, up 59% year-on-year, said Vu Duc Giang, chairman of the Vietnam Textile and Apparel Association. He added that the sector expects to achieve USD 12.7 billion in export revenue for Q1 2022.

According to Pham Xuan Hong, chairman of the Association of Garment Textile Embroidery and Knitting in Ho Chi Minh City, many local textile companies have received large orders which will require their factories to operate at full capacity until September this year. These manufacturers include Thanh Cong Textile Garment Investment and Trading JSC and Garment 10 Corporation JSC.

Moving forward, Vietnamese clothing manufacturers plan to generate more business revenue through sales exports to European markets, which have been given a boost by free trade agreements entered into force recently with the European Union and the United Kingdom.

Other sectors in Vietnam’s economy are also seeing an upturn in new orders that are driving an increase in manufacturing activity. In the timber industry, many companies have received bulk orders due to an early resumption of production operations, which will keep factories running at full capacity until Q3 or the end of 2022.

Another sector that has registered strong growth is the electronics industry. Since the 2000s, global electronics brands such as Samsung, Intel, and LG have made significant investments in manufacturing facilities in the country.

In the first quarter of this year, the export value of mobile phones and parts, electronic products, computers, and electronic components hit USD 27.3 billion, nearly half of last year’s total exports of USD 57.5 billion.

In the year ahead, more foreign enterprises are expected to invest in manufacturing projects in Vietnam. Lego recently announced plans to build a USD 1.3 billion carbon-neutral factory in Binh Duong Province. South Korean electronic components manufacturer Samsung Electro-Mechanics will spend USD 920 million to expand a production facility in Thai Nguyen Province, while Apple supplier Goertek is pouring USD 306 million into an electronics factory in Bac Ninh Province.

Taiwanese manufacturers are also strengthening their manufacturing presence in Vietnam. Taiwan’s Compal Electronics, which makes laptops for some of the world’s largest computer brands such as Dell, Google, and Amazon, has invested USD 500 million to build a factory to produce notebooks in Vinh Phuc Province. The electronics maker has also pumped USD 50 million into another electronics manufacturing facility in Vinh Phuc. “We are expecting to have 15,000 more staff join us by the end of the second quarter,” said KC Chen, deputy general manager of Taiwan Compal Electronics in Vietnam.

“There are many Taiwanese companies that wish to base their production in Vietnam,” said Chien Chih-Ming, chairman of the Council of Taiwanese Chambers of Commerce in Vietnam, who added that Vietnam will play a key role as global firms rethink their supply chains in Southeast Asia.

As foreign investment in Vietnam continues apace, a significant number of future investors will come from countries such as Japan, South Korea, and Taiwan, said the Foreign Investment Agency (FIA), the investment promotion agency of Vietnam’s Ministry of Planning and Investment. International firms from the EU could also relocate to Vietnam due to the Russian invasion of Ukraine.

Vietnam’s improved economic outlook, which is driven by the manufacturing sector, has also given the country’s stock markets a boost. The average daily trading value on Vietnam’s bourses reached VND 30.8 trillion (USD 1.3 billion) per session as of the end of April, up 15.9% year-on-year, according to the Ministry of Finance. At the end of March, the total market capitalization in Vietnam rose 3.4% from the previous quarter to hit VND 1.8 trillion (USD 78.4 million), which is roughly 21.4% of the country’s GDP.

Judging by its economic growth forecast, Vietnam’s ambitious economic development plan appears to be on track. Based on its socio-economic development strategy, which is divided into three stages, Vietnam aims to achieve USD 4,000 per capita income by 2025. In the second stage, by 2030, Vietnam is expected to become a developing country with a per capita income of USD 4,000 to USD 12,000. In the final phase, by 2045, Vietnam will achieve developed country status with a per capita income of more than USD 12,000.

At the 13th Party Congress last year, the Vietnamese Communist Party (VCP) also set targets for the country to achieve GDP per capita of USD 5,000 by 2025 and developed status by 2045.

This article was adapted based on a report posted byMaizi Chinaon WeChat that has been taken offline. KrASIA is authorized to translate, adapt, and publish its contents.