While the mobile payment sector has been seeing a meteoric rise in India since the pandemic hits as people are avoiding paper notes for hygiene purposes, WhatsApp Pay bucked the trend as its total transaction in January dipped by a whopping 31% month-on-month.

According to the latest data released by the National Payments Corporation of India (NPCI), the company processed 0.56 million UPI transactions worth INR 36.44 crore (USD 5 million) in January 2021 against 0.81 million transactions worth INR 29.72 crore (USD 4 million) it recorded in December 2020. UPI (Unified Payments Interface) is an indigenous payment network created by NPCI that allows instant money transfer. In comparison, Walmart-owned digital payment platform PhonePe recorded 968.72 million UPI transactions in January, retaining its top position, while Google Pay and Paytm came in second and third, respectively.

WhatsApp Pay’s debacle could be ascribed to its relatively lesser-known brand awareness. “WhatsApp hasn’t spent any resources in consumer awareness or marketing of its digital payment offering. Despite having a huge number of daily active users, very few of them know that WhatsApp allows you to make payments as well,” Arnav Gupta, analyst, digital business strategy at Forrester, told KrASIA.

Read this: ConveGenius uses WhatsApp to help students in rural India keep up with schoolwork: Startup Stories

Before it got the nod from the authorities late last year to roll out its payment offering, WhatsApp Pay was operating in a beta mode with payment service limited to only a million users. People in the industry were hoping with a mass scale implementation, albeit still limited to only 20 million payment service users, it will soon be in a position to dominate the digital payment space thanks to its over 400 million chatting service users in the country. However, since its rollout at a mass scale in November last year, WhatsApp Pay has managed to facilitate only 1.6 million transactions on the platform till January this year.

Local media

(ET) that quoted a person close to WhatsApp Pay said a slow start is deliberate and is not a cause of concern for the company. “We have knowingly gone slow with onboardings and are working on building the right technology and teams to emerge as an important player in enabling India’s digital ecosystem,” the source told ET.Last year, when Facebook invested USD 5.7 billion in Jio Platforms, a digital subsidiary of India’s most valued company Reliance Industries, both the firms agreed that WhatsApp will play a major role in kickstarting Reliance’s online retail endeavor, Jio Mart. However, there hasn’t been much activity in that space till now and it’s yet to be seen how soon Reliance rolls out Jio Mart’s products on WhatsApp.

“Since Jio also has a digital payment platform, Jio Pay, there’s a conflict of interest for Reliance. Before moving ahead with its partnership with WhatsApp, it is figuring out how to navigate these matters as it would not want to have its license go waste unless they have some solid profitability plan,” Gupta said.

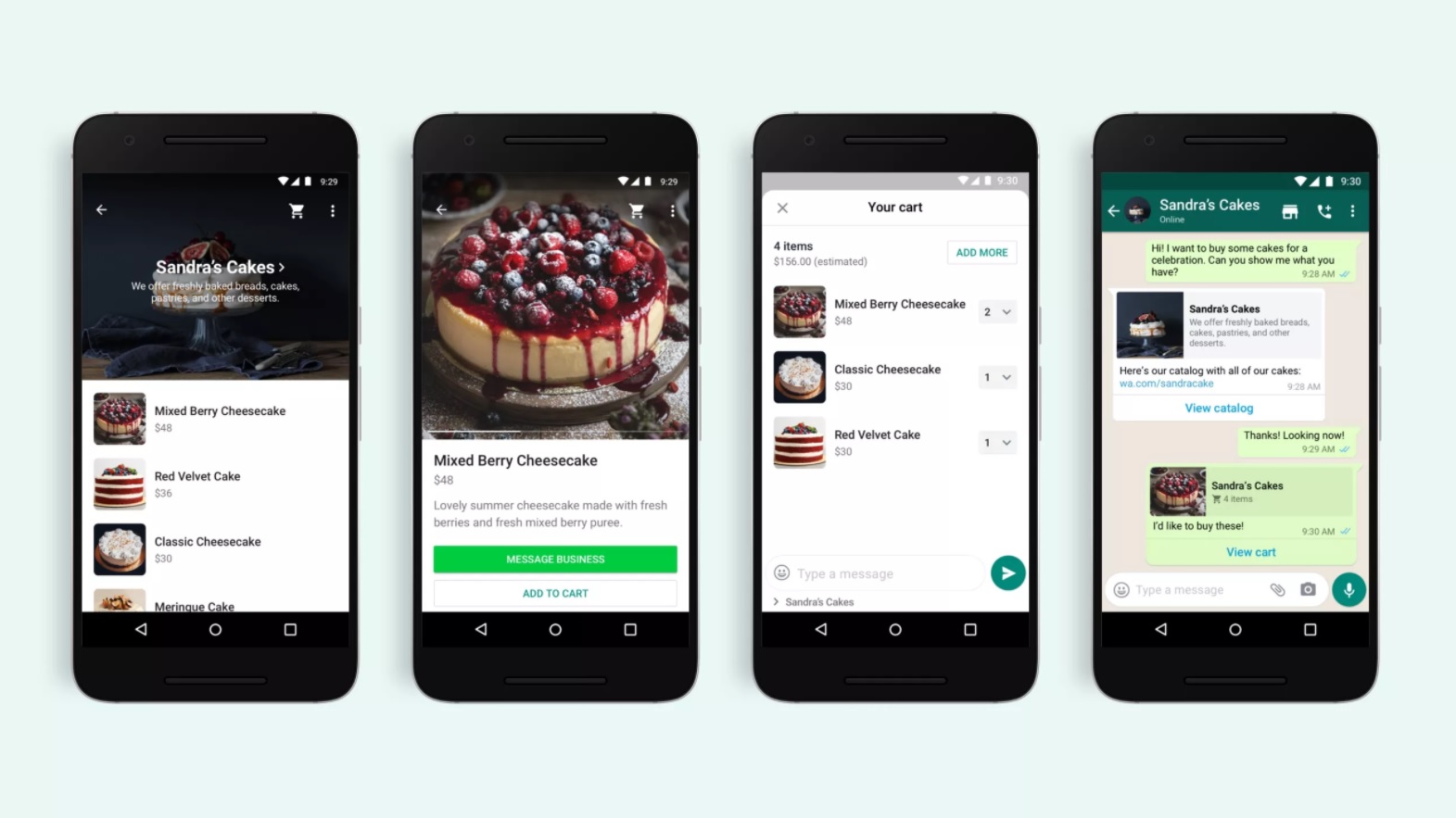

To bolster its payment service, WhatsApp introduced ‘Carts’ in December last year that allowed businesses to upload their products catalog on the platform thereby giving shoppers an option to directly purchase from the messaging app.

“The company is trying to figure out different use cases that it can implement on the app and how it can leverage the familiarity bias it enjoys to onboard more users to make payments on WhatsApp,” Gupta said.